Edited by Muhammad Iqbal

I wrote an open letter to the putative head of modern Deobandism (a Salafi offshoot in the Indian Subcontinent), Mufti Taqi Usmani, about six months ago concerning the issue of mortgages, which he as a scholar claiming to represent the Sunni Hanafi School declared to be forbidden. Obviously this had a huge impact on practising Muslims ability to fund the purchase of their own home.

You can read that letter here: https://shaykhatabekshukurov.com/2016/01/31/mortgages-an-open-letter-to-sheikh-taqi-uthmani/ (my position, in contradistinction to that of Usmani, which I proved from the authoritative Hanafi school, is that mortgages, as they exist in the West are permissible, and not subject to the ‘riba’ or ‘interest’ which is prohibited in the Quran)

Usmani believes that the standard mortgage is impermissible. That’s why he, in conjunction with banks, has produced a ‘new version’ of mortgages which he believes to be permitted. Many thousands of people are still waiting for his response on this important issue which concerns both current home owners as well as those who wish to get on the (increasingly difficult) property ladder. In my open letter I only mentioned the very tips of profound issues, hoping that he would understand. I actually said in my article;

”This is all I wanted to present to you. I did not go too deeply into the details, proofs and references because I know that you already have enough knowledge of these.”

And I said;

”I don’t doubt that this issue is known to a person such as yourself – I just mention these examples to clarify what I am talking about.”

And;

”I do not doubt that you are aware of this and there are many examples of this issue.”

I didn’t want to talk about the issue deeply because I felt that it would confuse the laymen. I just went through the points which seemed to have confused Mufti Taqi and made him arrive at his erroneous conclusion, and I gave him small points about his assumptions being incorrect.

But things have changed since then – I have received his response to my article about the time of the night prayer (Isha) in the UK where there is no true night (as occurs during summer in Northern Climes). Based on that response, which I felt frankly did not understand nor address any of the pertinent points and more worryingly seemed to show a brazen disregard for the Hanafi School (with Mufti Taqi having previously taken every opportunity he can to show his greater regard for non-Hanafi and Salafist authorities instead), I then assumed that I had to explain each and every point in very detailed way.

I am aware that Deobandis sectarians have taken my open letter as ”insult” and as a ”threat” and ”challenge”, as they are wont to do with any questioning of their position (along with, it seems for them, mandatory accusations of ‘heresy’ for anyone who disagrees with them), as opposed to engaging in an academic manner. That’s why they’ve been working hard for six continuous months to ‘refute’ it.

I personally find it foolhardy to take academic issues to a personal level. The religion of God is not someone’s back-yard. It is not bad if someone proves you are wrong, unless you believe that you are God. Everyone beside God makes errors. And the best among them is the one who admits his error. So the question is not about ”can a human make an error?”, rather the issue is ”can humans admit their errors?”. In our case, Deo-taimawites cannot admit it verbally – even though they accepted it practically, which I will show.

For six months I didn’t get any valid response except insults towards me in general terms and on a very personal level also. It is a very strong sociological proof that I am in the right otherwise they wouldn’t need to bypass the proofs and go directly to insults.

Besides that, a few molanas and sheikhs were confused about a few issues which they seemingly couldn’t understand. I will try to help them to understand these issues in this follow up article.

The most important thing is, from the outset, everyone agreed with me that Mufti Taqi was wrong in considering UK mortgages as ”banks lending money”. Everyone accepted that it is not “lending” but it is “Tawkeel“. And everyone accepted that we don’t look at what the bank and costumer say happens terminologically, but we look at what practically happens. No one tried to prove that Mufti Taqi is right in classing a mortgage as ”borrowing money from the bank”.

You would think that such a catastrophic error by a senior scholar on such an important an issue as home ownership would give these people pause for thought. Sadly not. People simply resorted to outlandish justifications for their entrenched position and were confused on some other issues such as;

- Two or more prices in one contract is ‘not allowed’

- Fluctuations of the price invalidate sales (they say)

- Two contracts in one is not valid (again, they say)

Based on that I could just turn around and say: ”My case with Mufti Taqi is closed. His claim is rejected by everyone including his own followers (I mean Deobandis and Taimohanafis) with no need for any further consideration”. They also calmed down a lot, going from calling mortgages ‘haraam‘ and ‘interest’ and ‘worse than incest’ to the much more milder ‘dodgy contract arguments they meekly retreated to. You see this response from them a lot – for example, talking big about science and then a scientist turns up and they suddenly make rather less dramatic claims.

But in another six months or so, perhaps Mufti Taqi will respond, so he can still comment on it if he wants to clarify his stance for his followers. Maybe he is ‘busy’ as his followers say. However, he seemed to find time to impact the housing opportunities of millions of Muslims previously, as well as liaise with banks and authorities and organisations in some countries etc so I hope he will do UK prospective homeowners the courtesy of a few edifying remarks at least.

On the other hand, I must say on a personal note, I find it funny to see the members of many sects all around the world trying to insult me. It includes Salafis, Deobandis, Berlawis, Hizb Tahreers etc from Saudi, Canada, Jordan, Sweden, Holland, UK, USA, Pakistan, South Africa etc. It is not just laymen but “Muslim” celebrities such as ‘daw’ah’ carriers, muftis, molanas, mullas, shaykhs, preachers, bloggers, blaggers, researchers, PhD’s, ‘peers’ etc… In my case, on this issue and many others, it has been carrying on for almost five years publicly and about ten years in total.

But the funny thing is till today, they didn’t bring anything substantial. They only brought personal insults, labelling, catching on my English spelling and grammar mistakes, insults about my clothes etc…

Each time they think they found an academic error, they come out of their bolt holes very proud and excited with Disney style ‘magic bubbles’ emanating from them, giving the impression to people that everything is finished. Even some of my friends start feeling sorry for me thinking that I was wrong.

When I write a ten line or so response however for example, these individuals invariably run back into their internet cubbyholes and forums disappear as if nothing ever occurred.

It isn’t because I am in any way special or arrogant that I say this. In fact, these people merely represent the Salafist affiliations of their paymasters and supporters. They try to railroad their idiosyncratic positions onto the back of the goodwill that Hanafism and Sunnism enjoys in the subcontinent and elsewhere. Therefore, anyone who is honest and even moderately versed in real Hanafism and can address the sources in Arabic (as they are counting that you cannot), will be able to show their radical departures from this school. It is merely their ‘public relations’ that prevent them from admitting that they are in no way Hanafis and often not even Sunnis, though to his credit, Mufti Taqi has gone on the record and said that he prefers the opinions of Salafi icons such as Ibn Taimia as opposed to Abu Hanifa or the Salaf (early Muslims). However, for the purposes of political expediency, it seems his followers lack his honesty.

Then it stays calm except for personal insults for a while. Then another molana gets inspiration from “God”, and comes out of his hole and starts a new circus, complete with a lot of clowns, creating a lot of dust and bubbles to give the same impression to the people. Again I write another article and prove that it was a ‘message’, but not from God.

And it carries on and on and on…

This scenario proves two things:

- The strength of traditional Islamic arguments from the Hanafi School, and the tough and long research behind it. That’s because thousands of scholars from all sects trying the best they can to tackle them are still failing miserably.

- Dishonesty and low academic level of the scholars in our century. Dishonesty, because if they would be honest they would accept my arguments publicly after being unable to disprove them. But instead they go on with personal insults. I think they should stick with personal insults, as they are really good only at that. Their colleagues did exactly the same with the Prophets and saints. Each single prophet has been insulted after the dialogue. Insults were about everything including their honour such as adultery, rape, murder, theft, their family members committing adultery, magic, bringing a message from Satan, being under the effect of magic etc…

So, I think their contemporary heirs should also stick to insults and leave the academia to the heirs of the prophets, the genuine scholars who aren’t scrounging for fame or petro dollars.

Now I will clarify the above mentioned three points.

When I was writing the open letter I was assuming that there is good knowledge of Hanafi fiqh and good training on reading and understanding the Hanafi texts with my addressee. Now, when I know the depressing reality, I will try my best to bring it to his level of understanding, and break down the issues to make it as easy as I can. Also, I won’t give only hints to understand, but I will explain everything in very detailed way with lots of proofs and examples. Let’s start now, and may God help us.

- Two or More Prices in One Contract

As we know, mortgages are not only sold with one fixed time limit. Banks will actually offer several options of payments starting from one year (some of them even six months) as a minimum time limit, going up to 30 years or even more. Most of the banks can give you a contract up to your retirement age, some even beyond that.

Based on that, the agreement between bank and costumer could differ from 1 to 30 years. No doubt that the price paid by the customer for the house will differ depending on the period which is agreed between the bank and the costumer. For instance;

- Price of the house is £100,000 – that is if you pay cash.

- If you make an agreement for 5 years it will be (for example) £105,000.

- If your agreement is for 25 years then £130,000.

- If the agreement is for 30 years, it will be £145,000

So, each period of repayment will have its own price. Now, the question about this issue;

”Is it a problem that same commodity (a property in our case), has different price based on the time period of the contract?”

I had already answered that as; ”There is no problem!” in my original article and I gave what I thought was a sufficient example from the famous and authoritative Hanafite text ‘Mukhtasar Quduri’ thinking that Mufti Taqi and others know these issues already. But I sadly saw that they have no clue about these issues whatsoever – which is no problem, no one knows everything, but then do not give potentially catastrophic fatwas based on erroneous premises. That’s why I have to give them some more proofs and examples.

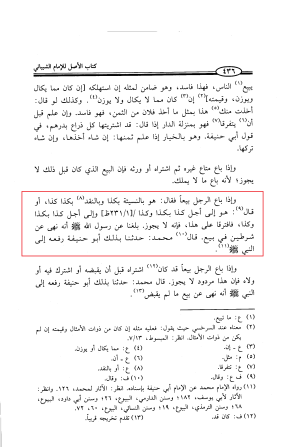

Here is from ‘Mabsoot’ of Imam Muhammad (obviously I am not using it as a proof);

Follow the red box;

‘If man sells a commodity for delayed payment for such and such amount but for cash payment at another price, or he says for such and such period that much, and for some other time period another price, then they go away, the contact is void’

This proves what I said perfectly. If you give two or more prices without specifying one, then your contract is invalid. That is because ”any ambiguity that leads to a dispute, invalidates the contract”

Here is the Hanafi Imam Bazzazi (I know out opponents are allergic to using Hanafi Imams to prove the Hanafi case and bring Shafis, Malikis, and above all Salafis but…) narrating from an authentic copy of ‘Mabsut’;

In the blue box:

‘Muhammad said [about two prices for the commodity and for the stitched clothes and two time limits for handing over the sold commodity]; That is invalid for the reason of ambiguity of the time limit. If they agree on the time it becomes valid’

Here is the confirmation from Shams Aimmah Sarakhsi (I would say that no one would be brazen enough to question the authoritativeness of this Hanafi Imam, but we saw that they are willing to reject Abu Hanifa himself when it doesn’t suit them – for the purpose of killing gays or thrashing their wives, so let’s not tempt them);

In the red box, Imam Sarakhsi is confirming the above mentioned point and further saying; ‘But if they agree on the time and confirm it then the contract is valid.’

Ironically one of the Deobandi molanas used these two texts to prove that mortgage is haraam because there are two or more prices. This is surely a hilarious gaffe, but the joke will be lost on said moulana I am sure. Since they like to insult my English, let me say that in Russian they say about this type of behaviour; ”Смотрю в книгу и вижу фигу”!

Well, you can expect it from them as they have very small knowledge of Hanafi fiqh compared to spurious fatwas about killing gays or beating your wife (for non-religious infractions no less) or how to incite violence and uprisings and securing cash from Saudi and Qatar etc.

Also, there is no bank in the world (unless they have some type of Deobandi or Taimawi bank) that gives you a mortgage without agreeing on a fixed and 100% confirmed time period anyway. So what are these guys talking about?!

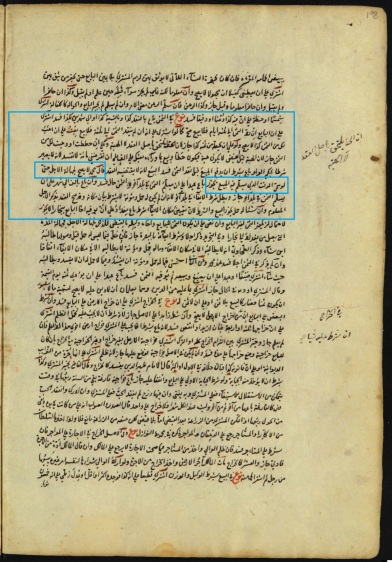

Here is a text from ‘Kasani’ volume 5;

Follow the red;

‘One of the conditions for validity is that the Price and Commodity have to be clear enough to avoid friction. So, any contract with a lack of clarity which can cause friction will invalidate the contact. But if the lack of clarity doesn’t lead to friction then it is valid’

And in our case we have a fixed agreed time limit which causes a fixed price (allowing for fluctuation in currency value and inflation).

Now question; isn’t it that the bank will offer different time limits from 1 to 30 years?

Answer; Yes, they offer many different prices and different contracts, but without you choosing one of them they won’t give you a mortgage at all. Which means it will have several prices initially, but then you agree on one – and one only. All of the different prices that bank initially offers you won’t effect on the validity of the mortgage after the agreement and confirmation (I already clarified this in my initial article but they ignored it or despite their ‘excellent’ English which provoked them to criticise others’ English, they were unable to understand things in plain English themselves).

Imam Kasani says;

‘If seller says: The price of this slave is one thousand if you pay within one year, and 1500 if you pay in one and half years, then it is an invalid transaction. Also, if he says: I am selling it for the price of its profit then it’s an invalid transaction. That’s because the amount of the payment is unknown. But if he finds it and agrees for it within the Majlis [meeting], then it will be classed as valid, because the reason for it being void was non-clarity of the price’.

‘If seller says: The price of this slave is one thousand if you pay within one year, and 1500 if you pay in one and half years, then it is an invalid transaction. Also, if he says: I am selling it for the price of its profit then it’s an invalid transaction. That’s because the amount of the payment is unknown. But if he finds it and agrees for it within the Majlis [meeting], then it will be classed as valid, because the reason for it being void was non-clarity of the price’.

Kasani carries on;

‘If the time of payment is known in the non-cash contract then it is valid, but if the time is unknown then it is not valid. If they agree to make the payment on something which differs in a big scale such as season of wind or rain or arrival of someone or someone’s death. Same also if they agree to make the payment on something whose ambiguity is not that big, such as season of collecting the fruits, or Nawruz, or Jewish Jubeel etc… then it is not valid too…

After making this invalid contract, if they disregard the ambiguity of the time of the payment within the same Majlis, then this invalid contract becomes valid’

So, we learned that the reason for the contract being void is having more than one price without agreeing, or attaching the time of the payment on something which they don’t know accurately.

Here is ‘Quduri’;

He is confirming the same points; ‘If they don’t know the time limit of the payment then it’s not valid. If they attach it to Nawruz then it is valid if they know when it is, otherwise invalid. If they attach the payment to the season of fruit collecting then it is not valid unless they agree to disregard the time limit’.

Here is Marghinani confirming the same thing;

Here Marghinani is confirming the invalid transaction becoming valid if they disregard the ambiguous time limit, even after making the contract;

Here is Bazzaziyah, confirming the same thing: if you remove the ambiguity and confirm the time it is valid.

I can carry on giving many more texts and all of that will confirm the same thing. But again, if Deobandi ‘muftis’ and ‘molanas’ will not find this enough then they can leave a comment and ask me, so I will give them some more quotes. (However, I regret that I can only quote from Hanafis but not their authorities, which are not Hanafi but their own latter day 19th and 20th century ‘Imams’ and Salafi archfiends such as Ibn Taimia, who allow for all kinds of things, such as burning people, lashing your wife for no reason other than you felt like it and cutting off people’s clitoris’ because you feel like it too).

I think this issue of having more than one price is now cleared up for those people with a normal level of understanding. I hope it was enough even for Deobandis, because I explained it on the level of people with the minimum level of understanding.

Just to summarise it;

- Everyone accepted my point about mortgage not being a “money lending” from the bank but it is “Tawkeel” – in Sharia terminology, this word is used for the same two meanings for which it is used linguistically; “to defer the control over something to a representative’’ and “preserving something by the representative’’. This was a hideous error on their part but they just took it in their stride and kept decimating the finances of vulnerable Muslims regardless.

- If there are two or more prices in one contract, then it is valid if they agree on one of them. One would have thought this was self-evident but sadly not. Maybe they will blame my bad English for their failure to understand?

- If the parties involved don’t agree during the contract on one of the prices but clarify it during the same Majlis (meeting), then it is again valid.

- Having more than one price in the initial offer of the bank doesn’t invalidate the contract as long as they chose one of the offered prices.

And obviously, Non-Deobandi banks make sure that there is very clear agreement on the time limit and price before they will give you the mortgage.

Some may ask;

”I know that they agree on the fixed time period for the payment for example 25 years, but price may change during that long time because of the value of the currency. Does that effect on the validity?”

I say to this that in Hanafi texts we have two different things, which may look the same for the people who are not qualified in Hanafi fiqh;

- Offering two or more prices during the contract

- Agreeing on one fixed price but then the value of currency changing.

As for the first point, I have just explained that. So, as long as the seller and buyer agree on one price, then the contract is valid. The possibility of the value of the currency raising or falling is not related to this issue.

As for the second point, I will explain it in the next chapter.

- Fluctuation of the Price

Just to remind you – we already crossed the stage of bank offering more than one price, then the costumer accepting one of them. So far, so good. There is no reason for invalidity so far.

As for the issue of the possibility of the price changing after the agreement because of the value of currency changing, does this effect the validity?

In the past, when Abu Hanifa used to live, they would mainly use the Dinar (golden coin) and Dirham (silver coin). They would use the Fils (iron coins) just to support the prices between one dirham and two dirhams. In some parts of the Muslim world 8 Fuloos would equal one dirham, and somewhere else it would be 10 Fuloos to one dirham. But most of the time they wouldn’t use 16 Fils to buy something whose price is 2 dirhams.

Using the gold and silver would secure contracts from the fluctuation of the market that we have now. But towards the end of the life of Abu Hanifa and in the period of Abbasids and onwards, they started using Fils as the main currency. In the time of Abu Yusuf and Muhammad (followers of Abu Hanifa) it was a widespread currency. Because of that, they started having fluctuation of currency, and devaluation of it.

Scholars then looked into this new issue and gave us their understanding of it. But as I said, ”devaluation of the value of the currency” is totally different to the issue of ”offering two prices on one commodity”.

As I promised, I will talk about the issues in very detailed and easy way so our Deobandi friends can understand. I apologise for any boredom caused to non-biased people.

In order to talk about ”fluctuation” we need to know one important issue.

There are some new sects of ”Islam” who are against using any currency beside Gold and Silver. Actually, they copied most of their ideas from non-Muslims thinkers and political parties which made far better and detailed arguments about the ‘gold standard’ (but they won’t admit that of course, because these groups, such as HT, are militantly anti-Western and anti-Sunni). Now, I don’t want to expand on it, but want to clarify that it is permissible to use Fils currency in the Hanafi school.

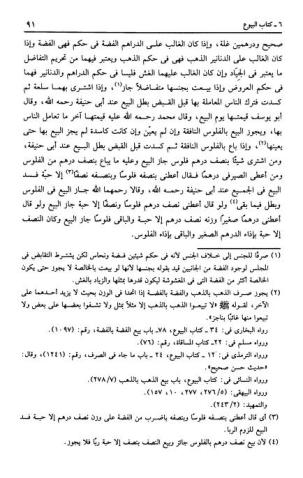

It is from Marghinani;

In the red box;

‘It is permissible to use Fuloos, because it a commodity that has a value, and it is classed as a currency according to the economic terms. Therefore, if it is still in use you don’t have to specify when buying. If it is not in use then you have to specify’

He means, for example if you are using the current GBP then you can just say; ‘It is ten pounds’ (or it was before ‘Brexit’). But if you are using the pound from WWII then you have to specify it.

Here is Quduri confirming the same points;

Imam Nasafi, yet another famous Hanafi (I should clarify – famous for Hanafis, not for Salafis pretending to be Hanafis) is confirming the above points;

Validity of the transaction with a currency which is not a gold nor silver is well known and confirmed nearly in each single Hanafi text. But again there are few ignorant sects who say; ”In the dajjalic system they don’t use gold and silver as a currency!”. As we see, the Sunni Hanafi school falls under “Dajjalic system “. And it has the most followers. Strange.

I would advise them to study properly and to stop following slogans which have no basis in the Real Islam.

Gold and Silver is stronger than the banknotes because it has its intrinsic value which is not based on banks or any other economic or political institutions. Banknotes are weaker because they don’t have any intrinsic value besides the one they are given by the Bank or some other institute. For example, grossly speaking, if the Bank of England collapses, its banknotes will become normal paper with some paintings on them, but Gold and Silver will carry on holding their value, unless you find a massive new supply of them, which is unlikely. Based on that, we can understand that the country which uses Gold and Silver as the main currency will have a much more balanced market and economy. The country that uses paper money will not be as stable and will be under the continuous risk of economic collapse, currency speculation etc.

In the countries where they use banknotes (i.e all of them nowadays), they have two ‘new’ terms in the market, one of them is ”devaluation” of the currency and the second is ”currency collapse”. Each of them has its own ruling in Hanafi fiqh, and second has its own name which is ”Kasad”. In a few words, Kasad is when a currency is no longer in use. It used to happen very rarely in the time of Sahaba and Tabein that’s why we don’t find many texts about it. It started happening in the time of Abbasids more. I think the reason for that is that before, the Arabian territory was small and each single nation had their own currency, and they were able to afford using gold and silver as currency. But when Umayyads and Abbasids started expanding geographically they had a shortage of gold and silver, so they had to use some other commodity as currency. Just to clarify, I am not a historian nor economist. So I apologise for talking about this issue. However later scholars spoke about the issue of Kasad more than scholars of Tabein such as Abu Hanifa. Muhammad spoke about Kasad more than Abu Hanifa, Jassas spoke about it more than Muhammad, Ibn Nujaim spoke more than Jassas etc…the later you get the more common it gets.

I hope I won’t be mistaken if I say that starting from WWI, devaluation of currency became more often or even continuous. Sometimes it reaches to the point of 1000 = 1 or even more. I hope everyone still remembers Turkish Liras, or even how the Soviet Rubl fell after the collapse of the Soviet Union. Now we are witnessing the severe devaluation of Syrian Pound, or even the British Pound after Brexit.

Now, we do have some types of transactions where you can pay upfront and get the commodity after some time. This contract is called ”Salam”. Sometimes time limit of Salam could reach several years. For example, I come to you and pay you 100,000 GBP to buy 3000 kgs of Basmati Rice after 4 years. Let’s suppose after 1 year GBP will be re-evaluated and will equal to only 400 kg of rice due to catastrophic inflation. What do we do then? Any long term transaction will have high risk of Kasad or devaluation of currency which results different price for the commodity to the one which was agreed during the transaction. For example, during the agreement you settled on 100,000 GBP in the time period of ten years. But a few months after the contract, the currency lost its strength.

So, do we have to oppress the seller because he agreed on certain price while back? Is that what Islam tells us?

I understand if you pay all of that money straight away, even though the seller would still be at a disadvantage because a ‘normal’ person cannot spend 100,000 GBP in few months. And what do you think if you agreed that you would be paying in monthly instalments and not straight away?! Definitely it is an oppression on the seller.

Coming back to our issue: You agree to buy a house for 120,000 GBP and agree to pay 450 GBP monthly in the time period of 25 years. Most likely currency will lose some of its value. Let’s suppose that within 5 years 100 GBP will equal to 0.50 GBP, after another 5 years 300 GBP will equal 1 GBP after another 10 years 1000 GBP will equal 1 GBP (I am using an extreme example, but we have had wild fluctuations, for example famously in Weimar Republic Germany). It means that the seller definitely will lose on a very big scale!

As we know, it is not only houses which are sold on monthly instalments, but many others things. I don’t think I am wrong in saying that about 50% of buying and selling is based on it. If we follow that primitive way of thinking in which “you have to stick the price that agreed before the devaluation of currency”, then no one will sell anything, and it will lead to a huge mess or even wars and bloodshed. At the very least, we will have economic lethargy.

Now, questions;

- Does Islam order us to oppress the seller?

- Does Islam consider the issue of Kasad?

- Does Islam order the seller to give his house to you and on top of that pay you a money from his own pocket?

I know that no one likes banks nowadays (except Muft Taqi, who likes certain banks) and with good reason since the financial collapse of 2008 and the Libor scandals etc but nonetheless, the answer is a big no! (Obviously some sects disagree with us as we saw).

What do we do in the case of Kasad?

If you buy a commodity with Fuloos (a currency like coins or banknotes and not gold or silver or a commodity), then Kasad happens before you get the commodity into your possession then the transaction is void according to Abu Hanifa.

But what if it is possessed by the buyer?

Then it is not valid according to Abu Hanifa, but valid according to Sahibain. But they disagreed among themselves about how much exactly to pay.

Abu Yusuf said; You have to pay the value of the agreed price based on the value of the Fuloos on the day of agreement.

Muhammad said; You have to pay the value of the Fuloos on the last day when the Fuloos was used.

Ibn Nujaim confirms the above-mentioned things;

There are a few details about this issue which don’t effect what we are talking about, that’s why I don’t want to mention them. (Issues such as does Kasad have to happen everywhere in the world or is it enough that it happens in one place).

Anyway, what is the Mutamad (official position) of Hanafi school?

According to Qadhikhan and Burhan al-Aimmah, it is the position of Muhammad for the reason of being more suitable and gentler and easier for the People. Also, some sects may not agree for the reason that they like choosing the most harshest thing for the people even if that opinion is not in the Hanafi school or even not within Islam (as we saw above), such as stoning to death and burning or burning alive, or lashing the wives from 1 to 10 times for her doing something which is not considered a sin. That’s why I of course expect a new drama from them, for the reason that Qadhikhan and Burhan supported the lenient and easy fatwa of Imam Muhammad;

Ibn Nujaim is confirming (also narrating this confirmation from Burhan Bukhari and others) that the Hanafi official position is the opinion of Muhammad because it’s easier for the people;

Just to summarise it all AGAIN;

- Everyone accepted my point about mortgages not being money lending from the bank but rather that it is Tawkeel.

- If there are two or more prices in one contract then it is valid if they agree on one of them.

- If they don’t agree during the contract on one of the prices but clarify it during the same Majlis (meeting), then it is once again valid.

- Having more than one price in the initial offer of the bank doesn’t invalidate the contract as long as they choose one of the offered prices.

- Contract is valid even if the currency which is used is not Gold and Silver, considering the high risk of fluctuation in the paper money.

- If contract was based on banknote payment and Kasad (withdrawal of the currency) happened, then the buyer has to pay based on the price of currency which was on the last day it was used.

Someone may say; How come you are not following Abu Hanifa but Muhammad?

Answer; Hanafi school is not only the opinions of Abu Hanifa. There are principles which have to be considered in order to know what is the official Hanafi position. One of the principles says; If there is a disagreement between Abu Hanifa and Sahibain we take the position of the sahibain if the issue is about a change that occurred because of change of the people and condition of the later times…

Another question; How do we evaluate the currency according to Muhammad?

We compare the value of the currency to gold which it had the last day before devaluation. (I will further explain it).

Another question; Does it have to be compared to gold? Is it something we know from Quran and Sunnah or Mujtahid scholars?

No, it’s just a suggestion from our scholars. But in the matters of Muamalaat we go with custom according to the Hanafi school.

Some may ask; we are not talking about the issue of Kasad where the currency is no longer in use, but we are talking about the issue when devaluation occurs with the currency.

I say: Sure, I mentioned the case of Kasad because the issue of currency devaluation is more or less same!

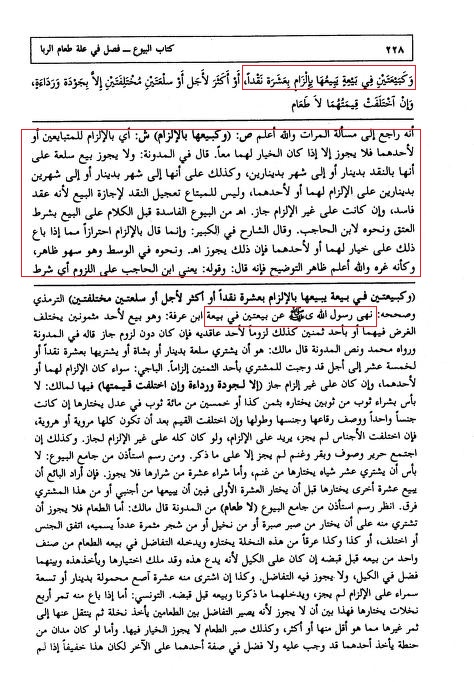

Here is Bazzazi saying that too;

‘If the value of currency increases or decreases then Abu Hanifa and Abu Yusuf first said; He has to pay nothing except what was agreed. Later Abu Yusuf changed his position and said; He has to pay its value when transaction took a place and commodity was possessed. And this is the official position.’

Here is Ibn Nujaim confirming what Bazzazi said;

Ibn Nujaim is quoting even more Hanafi authorities who confirmed the same position. Also, he clarified that value of the Fuloos will be compared to the Dirham, (i.e gold). For example you buy something for 100 Fuloos which equals 10 Dirhams. Then the Fuloos loses its value and becomes 1000 Fuloos for 1 Dirham then you have to pay the value of 10 Dirham i.e. 10,000 Fuloos.

Here Siraj confirms all of what Bazzazi said;

Here is Ibn Abideen also confirming what Bazzazi said about the currency losing its value in the buying and selling transaction:

- Two Contracts in One

The last issue which I want to discuss is the prohibition of the Prophet PBUH from two contracts in one contract, or in a different narration two conditions in one contract.

Many molanas and muftis and sheikhs were confused about my article from this angle. In my position, mortgage is nothing but Tawkeel and sale. Based on that they thought that it is void because it is ‘two contracts in one’.

From my side I say that this is one of the hadeeths that confused the Fuqaha (senior legislators or jurists). They didn’t agree about its meaning. However, in the Hanafi school this hadeeth is about the first issue that we spoke about. What I mean is that this hadeeth is talking about offering two prices for one commodity without agreeing on any one price. Hanafi scholars said that it is invalid transaction based on this hadeeth.

It is one of the copies of ‘al–Mabsoot’ of Imam Muhammad. It says:

‘Offering two prices without agreeing on one invalidates the transaction. And that is the meaning of hadeeth where prophet PBUH forbids from two conditions in one contract’.

This is from Imam Sarakhsi, who is confirming that the meaning of ”two conditions in one transaction” is two prices in one transaction without agreeing on one – and he confirmed that as soon as they agree on one of the prices, it becomes valid and the hadeeth is no longer applicable.

Here is Kasani confirming that the ”two conditions in one transaction” which is prohibited by the Prophet PBUH means two offered prices without agreeing on one of them.

But, as for including two contracts for example Tawkeel and a sale in one transaction, this is permissible. I actually mentioned an example from ‘Usul Shashi’ in my initial article. As usual, critics ignored and went on a ‘trollfest’ without reading the artcile.

Perceptive readers will notice how quickly the ‘haraam-ness’ of mortgages plummeted with these fanatics from ‘it is prohibited Riba from Quran and the same as incest with your mother’ to ‘well, two contracts in one might be bad according to an ahad hadith in non-Hanafi Islam’. It is an example of how thick these sectarians lay it on and how fast they beat a retreat when confronted with the facts. In this case, it is Muslims against other Muslims, but they do the same thing against atheists and enemies of religion and take the faith of many innocent Muslims with them.

Meaning of ‘Two transactions in one‘ in other schools

In Maliki school it is translated as ‘selling a commodity for ten pounds for cash, or twenty for late payment without buyer and seller having a choice in choosing between them two. But if they will have a choice then it is permissible.

Here is from Mawahib al-Jaleel;

The meaning of two transactions in one accordingly to Shafei school. There are two interpretations from shafei school;

- First is to say; The price of this commodity is ten pounds if you pay cash and twenty if you pay later. Then they don’t agree on one of them before going away (deobandi type of transaction). It is the same as Hanafi interpretation, and this is the strongest one.

- Second; To say I sell you my house for ten with the condition that you sell me your car for five.

This is from Majmoo‘ of Nawawi

Accordingly to Hanbali school, the meaning of ‘Two contracts in one contract’ is to say; ‘I sell you my house with the condition that you sell me your car’, or ‘I sell you my house with the condition that you rent your house to me’, or ‘I sell you my house with the condition that you marry off your daughter to me’ , or ‘I sell you my house with the condition that you buy my second house’.

It is from Mughni of ibn Qudamah;

In Hanbali school transaction is invalid only if there is are two conditions in it, but if it is only one condition then it is permissible. Further they disagreed in the meaning of ‘Two conditions’.

Obviously I am not the expert in Maliki, Shafei and Hanbali schools. That’s why I defer the research about the Mortgage based on these schools to its own scholars. But here I just displayed that Tawkeel and Sell in one is not the meaing of Hadeeth about ‘Two transactions in one’.

Conclusion

First of all I want to thank Mufti Taqi and Deobandi scholars for clarifying their position in opposing the Hanafi school. Further I want to say:

We saw that there have been a lot of attempts to refute the Hanafi argument but none of them had any success. It proves that the argument and proofs that I’ve presented are very tough and very strongly grounded. Based on that I say, the initial status of any buying and selling transaction is that it is valid unless you prove it void.

Imam Kasani says:

‘The initial status of the transaction is validity, and invalidity can occur by usury. Existence of usury in the transaction is doubtful. Doubt cannot invalidate the transaction!’

Kasani was talking about a transaction where there is a possibility of usury, but in our case we have a certainty that there is not any usury. The proof of this is that individual scholars as well as well funded and publicised institutes from all over the world have been trying to prove that a mortgage constitutes usury, but were unable to bring anything substantial whatsoever. All they brought were the abovementioned three points – which were wrong and not related to usury anyway.

This is somewhat pitiful, especially considering the huge impact their careless fatwas have had on the financial well-being of Muslim home owners and aspiring home owners. I guess it worked out well for those offering and consulting on ‘halal’ mortgages however, which are usually even more exploitative than the ‘haraam’ kind, seeing as none of the non-Muslim home-buyers are clamouring for them and the very same banks offering the halal ones ‘forget’ to promote them to the non-Muslims.

Just to summarise YET AGAIN;

- Everyone accepted my point about Mortgage not being money lending from the bank but rather it is Tawkeel.

- If there are two or more prices in one contract then it is valid if they agree on one of them.

- If they don’t agree during the contract on one of the prices but clarify it during the same Majlis, then it is again valid.

- Having more than one price in the initial offer of the bank doesn’t invalidate the contract as long as they chose one of the offered prices.

- Contract is valid even if the currency which is used is not Gold and Silver, even when considering the high risk of fluctuation in paper money.

- If contract was based on banknote payment and Kasad happened then buyer has to pay based on the price of currency which was the last day it was used.

- If banknote loses its value by becoming cheaper then we consider its value on the day of transaction.

- Prophet PBUH forbidding from two conditions in one transaction is not related to the issue of mortgage at all.

- Including Tawkeel and sale in mortgage is permissible accordingly to Hanafi School

At the end I want to say;

A lot of Muslims of our time from various sects, cults and institutions are unable to hold any kind of academic discourse. Since I started teaching in the UK I’ve been getting tonnes of insults. Since I’ve released my book ”Hanafi Principles of Testing Hadith”, Muslim ”scholars” and ”students” literally got crazy. The language they were using was terrible. I tried to contact the main heads of some of these sects to build up some relationship, but they were negatively prepared. Here are some examples of the words they were using ”Heretic, Kafir, apostate, Khabeeth, Idiot, Donkey, Swine, Hypocrite” etc…(however, if you criticise these same people just a little, or use a little bit of sarcasm on them, they will lament your bad manners for the rest of eternity and use it as an excuse to not respond to your academic points). I am not offended, but actually I thank them for all of their efforts. The Prophet PBUH says that the one who insults, backbites and slanders will gain the sins of the one whom he is offending. Obviously it was a great metaphoric explanation from the Prophet PBUH. So, I am grateful to all of these people for purifying me and cleansing me from my sins.

I know that some modern ”Muslim” celebrities from all sects are the worst ever examples of the real Islam even though they are the best examples of false ”Islam” which is created by slaves and servants of Umayyads and Abbasids.

I hope today’s article gave a bit better understanding of my argument. If not then I will release another one, to make sure that people understood.

Thanks for taking your time and reading my article. It shows that you respect my effort.

God bless!

Asalaam, shiekh I believe the honoured Mufti will be attending azhar academy in London ( Bromford road. Maybe you could approach him there why he hasn’t replied to your open letter.

LikeLike

Mufti Taqi is out of equation. Everyone accepted that it’s not bank lending a money.

Also, I reviewed his response on the issue of time of prayer. Based on that I don’t think he will do this issue any better.

LikeLiked by 1 person

May Allah Swt guide as all .ameen

” ana” is kafir.

Differences among schlors is bliss but scholars should be open to discuss issues.

We love you shaykh atabek shukurov.

May Allah swt have mercy up on you .

Aameen.

LikeLiked by 1 person

What if I agree to a 30-year mortgage and then pay it off sooner? I would then be paying more on a monthly basis so that the time period and the total price becomes less, and the quicker I pay off the principle, the lower the final price becomes. Does this mean that I must stick to the schedule and neither pay more nor less than the agreed upon monthly payment, or else the contract is invalid?

LikeLike

They won’t admit that they’re wrong, but they can’t afford to say nothing at all; I expect as vacuous a response as that offered to “your” (the Hanafi) stance on `Isha in high-latitude Summer.

So disappointing… and I used to think they were proper Ahnaaf!

Shaykh, please clarify the Maturidi position about Allah being able to lie; for myself, I only need a short response. I sent the question in to be answered on Ask the Alim but it never was, and the only thing I can find on my own is what I’m sure is the Ash`ari position (via Shaykh Abu Adam an-Naruji).

LikeLiked by 1 person

The Maturidi position as far as I am aware is that Allah will not do anything that is rationally impossible nor will he do anything textually impossible.

So the Maturidi position is that Allah cannot and would not lie in any scenario (Otherwise, what kind of God are we worshipping if he can lead us astray by lying?). The Deobandis are quite embarrassing on this issue as they claim to be Maturidis yet do not follow it.

It would be helpful if Shaykh Atabek can clarify further. Allah knows best and I hope He forgives any of my mistakes.

LikeLiked by 1 person

So same as the Ash`ari position then, that it’s intrinsically impossible, like creating another God or a perfectly square circle?

LikeLiked by 1 person

Mr Atabek IT SEEMS YOU ARE CRAVING FOR AN ACADEMIC DEBATE ON THESE MATTERS. PLEASE CONTACT THE MAJLISUL ULEMA OF SOUTHBAFRICA AND YOU WILL BE REFUTED THE WAY YOU DESERVE TO BE. MUJLISUL.ULAMA@GMAIL.COM

LikeLike

“You will be refuted the way you deserve to be.”

What a poignant example of the complete dearth of academic acumen and conduct for which the Shaykh has been impugning your various sects.

I really hope you aren’t a representative of any rank for your “majlis.”

LikeLiked by 1 person

As I said, these people treat the academical and religious issues as family drama battle.

They have no ability to hold a discourse. It’s for them a football match between Russia and France.

LikeLiked by 1 person

Shaykh, I’m almost at the point of begging you for an answer 😁

LikeLike

Yep, Ash’ari position is same in this matter

LikeLiked by 1 person

JazakAllahu khayr!

LikeLike

A/A Sheikh: At least in the US, the way it works is that the money is lent to you and you purchase the house. The house is always in your name and the bank has a lien on it. A lien is just a public record that says you owe the bank money. So I’m not understanding how this can be viewed as “tawkeel” because you’re not purchasing the property for the bank; in fact the property never comes under their name. I’m not sure if there is any difference in how it works in the UK. Barakallahu feek.

LikeLiked by 2 people

SYEDAHUSAINBLOG,

That’s my understanding too. I have sent the Shaykh a comment to this effect on his latest post on mortgages. My explanation waz more longwinded than yours. Let’s hope we can get a reply.

LikeLike

Another problem to consider: when you pay back the loan, the contract clearly distinguishes payback of interest versus principal where the first several years, you pay mostly interest and very little principal. This is very relevant because in the case of defaulting on the loan, and the property is liquidated by the local government, the bank gets a larger share. In other words, it’s very different than a typical Murabaha contract.

LikeLiked by 2 people

“Thanks for taking your time and reading my article. It shows that you respect my effort”

Shaykh Atabek is definitely a rare gem of a scholar. I pray that Allah increases his life and knowledge so that he can continue to help innocent and troubled Muslims in a time of mass confusion and violence.

LikeLiked by 1 person

Salams . Great article!

Few questions Shaykh if I may.

1) how do we deal with fixed rate mortgages and variable? Variable rate are based on interested rate of Bank of England PLUS interest rate that the bank has specified. So bank is charging you interest not based on devaluation

/) fixed rate is again controlled by the bank and its purpose is to profit from the transaction rather than just to adjust for devaluation of currency?

3) what about mortgage product fees?

4) what about moving mortgages ( remortgaged

Allah bless you

LikeLike

Waalaikum Salaam

Your questions show that you understood the article.

I should answer to your questions and some more questions in a new article inshaallah.

Thanks.

LikeLike

Salam Aleycum

Firstly, I want to express gratitude for the efforts you have exhausted in bringing contemporary issues within the Muslim community forward. It is a shame that there seems to be a lack of dialog between scholars on these issues which limits our critical understanding in such matters. With no prior knowledge apart from how the so called ‘Islamic Home Finance’ works; I now find myself in a position having read your articles wanting to understand opposing arguments. I am currently trying to contact learned scholars to bring this to their attention in aid to hopefully receive a written response. Thus far, I managed to gain a concise written reply from a leading figure amongst Muslims in the UK. At this stage he wishes to remain anonymous due to the constraints upon him that led to the somewhat concise. I hope that you will be able to respond so that he will then commit more time to then openly commence dialogue with you?

I as well as many other Muslims within my community want to be able to make a conscious decision on whether we go for a traditional mortgage or not. Your initiation of the articles has provided the opportunity for us to get closer to that decision. May Allah reward you for that ameen!

Here is the reply in response to your article, I hope that this will be the start of future dialogue on this issue.

Kindest regards

Umar

Basically, Sh Atabek is saying that a mortgage isn’t a loan from the bank to the individual, but rather the bank is asking the individual to act as a representative on their behalf (tawkeel).

He says it isn’t a debt because the borrower can’t do what they please with the money, they can only buy the specified house. His understanding is that it is only called a loan, when the borrower takes possession of the money to act as he pleases.

Because he isn’t acting as he pleases, he is in effect a representative of the bank, which is a permissible contract.

Having read this, it is obviously clear that this is a flawed logic to base the argument on.

The loan is a loan, even though the bank restricts its usage. I don’t see why restricting its usage takes away it reality of being a loan. it’s like someone giving you something on condition that you use it in a specific way, which doesn’t render it invalid.

Therefore, his premise is flawed and it just doesn’t follow through. Because when you are a wakeel (agent) you are acting on someone’s behalf to do something. I don’t follow the logic of this in a mortgage transaction.

To summarise, I would say it is a poor attempt to explain away riba in the mortgage contract.

LikeLike

Ask to explain what exactly did he summarise?!

All of them have been claiming that my argument is wrong, but when they’ve been asked for a proof they all agreed by consensus, that they don’t have a time to explain.

That’s why they prefer to stay ‘Anonymous’.

LikeLike

From my cursory reading the esteemed Sheikh has pointed out that for it to actually be prohibited riba the money needs to freely exchangeable by the burrower. The anonymous Sheikh you refer to is saying that money need not be freely exchangeable for it to constitute riba. Please excuse my ignorance but what is the evidence for or against either of these definitions?

LikeLike

Ask this anonymous sheikh about when something will be classed as debt in Islam?

It’s the same old game of carrying on repeating the same arguments which I already explained.

LikeLike